EB-5 Visa Success: Your Course to a United State Visa Through Financial Investment

The EB-5 Visa program provides a compelling chance for foreign financiers to safeguard united state long-term residency with monetary dedication in brand-new business. With specific investment thresholds and the possibility for significant economic influence, the program not just provides a pathway to a visa but additionally placements capitalists for feasible economic gains. Steering with the complexities of qualification demands and the application procedure can be intimidating. Recognizing these elements is crucial, as the benefits of effective involvement can be significant. What elements should prospective capitalists think about before initiating this trip?

Introduction of the EB-5 Visa

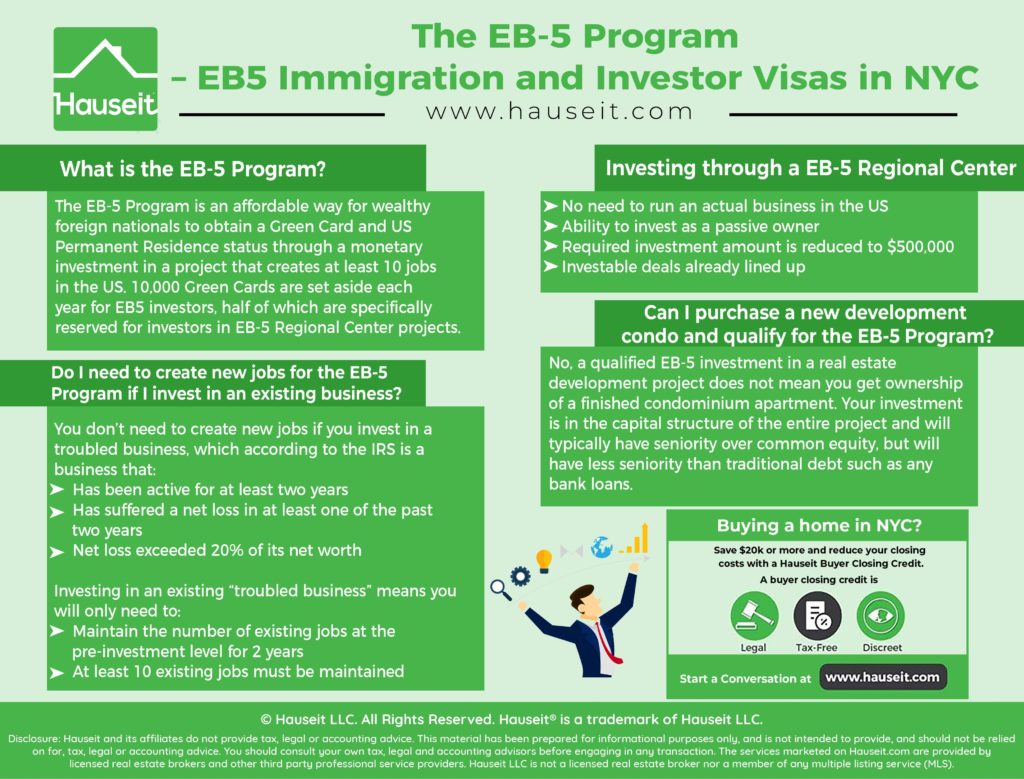

The EB-5 visa program personifies the principle of investment as a path to possibility, allowing international nationals to get long-term residency in the USA with monetary contributions to U.S. services. Developed by Congress in 1990, the program aims to promote the united state economic situation by bring in foreign resources and producing jobs for American employees.

To qualify for an EB-5 visa, capitalists should make a minimal financial investment in a new industrial venture, which can be either directly or indirectly through a designated Regional. This investment has to bring about the development or conservation of at the very least 10 permanent jobs for U. EB-5 Visa by Investment.S. employees

The EB-5 program offers a distinct pathway to irreversible residency, typically described as a "visa," which permits financiers and their prompt member of the family to reside and work in the United States. Additionally, the program has actually gained appeal because of the boosting demand for U.S. residency amongst affluent individuals seeking to protect a better future for themselves and their families.

Eligibility Demands

To take part in the EB-5 visa program, capitalists need to satisfy specific eligibility needs that assure their payments line up with the program's purposes. Mostly, applicants need to invest a minimum of $1 million in a brand-new company or $500,000 in a targeted work area (TEA), which is specified as a backwoods or a location with high joblessness.

Furthermore, the financial investment has to bring about the development of a minimum of ten full-time tasks for U.S. workers within 2 years. Capitalists are called for to confirm that their mutual fund are obtained with authorized methods, giving documentation to validate the source of their resources.

One more important requirement is that the investor needs to be associated with the day-to-day administration of the venture or policy formation, guaranteeing an active role in the company. Applicants need to additionally show their purpose to reside in the USA, either through straight involvement in the company or via their financial investment's effect on the united state economic climate.

Meeting these qualification standards is essential for a successful EB-5 visa and is essential to the general integrity and objective of the program.

Financial investment Options

In the context of the EB-5 Visa program, capitalists have a variety of investment alternatives available to them. These consist of Regional Facility Investments, which utilize merged funds for financial growth, and Direct Investments, where individuals can develop their very own companies. Each option comes with certain task creation demands that should be satisfied to get the visa.

Regional Facility Investments

Countless financial investment options exist within the round of Regional Facility Investments, making them an attractive option for EB-5 visa candidates. Regional Centers are designated by the U.S. EB-5 Investment Amount. Citizenship and Immigration Services (USCIS) to assist in financial investment opportunities that advertise financial growth and job creation. These facilities typically concentrate on large tasks, such as property friendliness, advancement, and framework ventures, which usually generate significant returns

Financiers can take part in a range of markets, including industrial real estate, eco-friendly power, and healthcare. Each Regional Center offers special jobs tailored to differing threat accounts and economic goals. This diversity permits EB-5 candidates to pick investments that line up with their interests and run the risk of tolerance.

Regional Center Investments typically require a reduced degree of participation from financiers contrasted to route investments. Normally, financiers do not need to be actively involved in the day-to-day operations of the company, simplifying the financial investment procedure. This framework not only enhances the likelihood of fulfilling the job production requirements however also provides a much more passive financial investment technique, which many candidates like. Regional Center Investments stand for a compelling pathway for safeguarding U.S. irreversible residency through calculated economic dedication.

Straight Investments Explained

Direct financial investments in the EB-5 visa program offer a more hands-on approach for investors seeking to achieve united state permanent residency. Unlike regional center financial investments, which merge funds for different tasks, direct financial investments require individuals to invest straight in a brand-new business. This version enables capitalists to have higher control and involvement in their company endeavors, allowing them to actively take part in the monitoring and procedures.

To qualify for the EB-5 visa through straight financial investment, an investor should invest a minimum of $1 million in a certifying service, or $500,000 in a targeted work location (TEA) where unemployment is high or the populace is low. The financial investment should protect or create at the very least 10 permanent jobs for united state workers within 2 years of the capitalist's admission to the United States.

Capitalists may think about various industries for straight investments, consisting of property manufacturing, hospitality, or development. The success of these financial investments hinges on comprehensive due diligence, as the capitalist presumes more risk and responsibility contrasted to passive financial investments in regional (EB-5). Cautious planning and strategic financial investment choices are necessary to make best use of both monetary returns and immigration benefits

Work Production Demands

To effectively browse the EB-5 visa process, recognizing task creation demands is vital for financiers. The EB-5 visa program requireds that each capitalist preserve or develop at least 10 full-time tasks for united state workers within 2 years of their investment. This demand works as a foundation of the program, showing the capitalist's dedication to adding to the U.S. economic climate.

Capitalists can accomplish this job development demand via numerous financial investment alternatives, mostly by either direct financial investment in a brand-new company or by buying a Regional Center. A direct financial investment usually includes the establishment of a brand-new organization entity that straight utilizes U (EB-5 Investment Amount).S. workers. On The Other Hand, Regional Centers pool funds from multiple capitalists to finance larger tasks, which can indirectly produce tasks

It is important for capitalists to guarantee that their selected financial investment pathway is compliant with the united state Citizenship and Immigration Solutions (USCIS) standards. Appropriate documents and evidence of task production should be sent to sustain the EB-5 application. Effective conformity not only facilitates the visa process but also enhances the possibility of obtaining an U.S. Visa through investment.

Benefits of the EB-5 Visa

The EB-5 Visa provides many advantages that make it an attractive option for investors seeking U.S. residency. Key advantages include a streamlined course to irreversible residency, the capability to include immediate family participants in the application, and the capacity for investment returns. Recognizing these benefits can aid possible candidates make notified decisions regarding their immigration and financial investment approaches.

Fast-Track to Residency

How can the EB-5 Visa serve as an entrance to permanent residency in the USA? The EB-5 Visa program is particularly developed to bring in foreign investors by offering them a structured pathway to acquiring an U.S. Visa. By investing a minimum of $900,000 in a targeted employment location or $1.8 million in a typical location, financiers can safeguard long-term residency for themselves and their instant relative.

One of the key benefits of the EB-5 Visa is its fairly short processing time compared to various other migration paths. Upon approval of the first application, financiers get a conditional Visa, valid for two years. Throughout this period, they can live and function in the U.S. while fulfilling the investment requirements. After two years, financiers can get the removal of problems, resulting in complete long-term residency.

Additionally, the EB-5 Visa does not need a funding employer or household member, making it an appealing choice for those looking for autonomy in their immigration trip. Generally, the EB-5 Visa presents an one-of-a-kind opportunity for financiers to not just expand their wide range but additionally develop permanent residency in the USA, enriching their individual and expert lives.

Family Addition Perks

A considerable benefit of the EB-5 Visa program is its capacity to consist of prompt household members in the immigration process. This arrangement enables the capitalist's partner and single children under the age of 21 to request permits alongside the key candidate. By extending this chance to relative, the EB-5 program not just enhances the appeal of investment in the United States yet likewise fosters family members unity throughout the migration trip.

Moreover, the inclusion of family participants means that they can likewise take advantage of the benefits connected with irreversible residency. This consists of accessibility to education, medical care, and the capacity to live and function in the U.S. Additionally, the path to citizenship appears to all qualifying member of the family after meeting the necessary residency needs.

The EB-5 Visa program subsequently offers as an effective methods for family members to secure their future in the United States, allowing them to build a new life with each other while taking pleasure in the varied chances that the nation needs to use. By focusing on family incorporation, the program acknowledges the significance of domestic bonds and aims to produce a supportive environment for immigrants seeking a far better life.

Investment Return Prospective

What makes the EB-5 Visa an attractive alternative for foreign financiers is its possibility for substantial financial returns. By investing a minimum of $900,000 in a Targeted Employment Location (TEA) or $1.8 million in various other areas, investors not only gain a path to united state long-term residency however also the chance to gain significant profits.

The EB-5 program encourages financial investments in job-creating jobs, commonly in realty or facilities, which can yield attractive returns. Several local facilities, which assist in EB-5 investments, have developed track records of supplying returns with varied jobs.

Furthermore, the investment is usually structured as a funding to the job, enabling the prospective return of the major quantity after the financial investment period, which normally extends five years. This twin benefit of residency and monetary gain makes the EB-5 Visa especially appealing.

Financiers likewise take pleasure in the benefit of limited danger exposure, especially when included with recognized regional facilities that take care of financial investments properly. As the U.S. EB-5 Investment Amount. economy proceeds to expand, the EB-5 Visa represents not only a course to a visa but likewise a critical financial investment opportunity with capacity for economic success

Application Refine

The application process for the EB-5 Visa is a crucial path for financiers seeking to acquire long-term residency in the United States. To start, potential applicants have to determine a suitable financial investment opportunity, generally via a designated Regional Center or a straight investment in a certifying company that meets the EB-5 standards.

When an investment is made, the candidate should finish Form I-526, Immigrant Application by Alien Investor, which calls for comprehensive details about the financial investment, the source of the funds, and proof demonstrating that the investment will create or protect at the very least 10 full-time tasks for U.S. workers. This kind needs to be submitted together with supporting documentation, consisting of financial declarations and organization strategies.

Upon authorization of Kind I-526, the financier is qualified to request conditional irreversible residency by sending Form I-485 or DS-260, relying on whether they remain in the U.S. or applying from abroad. If given, the investor and their prompt family members get a two-year conditional visa. To get rid of the problems, Type I-829 should be submitted within 90 days before the two-year anniversary, confirming job development and the proceeded viability of the investment.

Usual Difficulties

While seeking an EB-5 Visa can be an appealing avenue for financiers, a number go now of common obstacles might occur throughout the procedure. Among one of the most considerable obstacles is the demand for a minimal financial investment, which presently stands at $1 million or $500,000 in targeted employment areas. This substantial financial dedication can deter potential candidates or lead to monetary stress.

Furthermore, showing the resource of funds can be complicated. Investors must offer extensive documents confirming that their investment capital is originated from authorized ways, which can involve extensive economic documents and legal analysis. This requirement frequently extends the handling time, creating frustration for candidates keen to protect their visas.

One more challenge exists in the choice of a suitable Regional. Capitalists should perform due diligence to verify that the facility is reputable and has a record of successful projects. Errors in this field can bring about predict failings or, even worse, loss of financial investment.

Success Stories

Countless success stories show the possible incentives of the EB-5 Visa program for international financiers. For instance, a household from China efficiently browsed the EB-5 procedure, purchasing a genuine estate job in California. Within 2 years, they got their conditional visas, permitting them to develop a new life in the United States. Their investment not just supplied them with long-term residency but also added to task development within the local community.

Another notable situation includes a financier from Vietnam that chose to fund a friendliness task in New york city City. This endeavor not only met the work development requirements but likewise resulted in a rewarding business. The capitalist and their family are now thriving in the U (EB-5 Investment Amount).S., enjoying the advantages of their strategic investment

These success stories highlight the transformative impact of the EB-5 program. By picking the best projects and adhering to guidelines, investors can accomplish their objective of united state residency while simultaneously boosting economic development. As the EB-5 program remains to develop, much more households can anticipate similar success in their pursuit of the American Dream.

Often Asked Questions

Can My Family Accompany Me With an EB-5 Visa?

Yes, your household can accompany you on an EB-5 visa. Qualified dependents, including your spouse and children under 21, may get derivative visas, enabling them to immigrate to the United States along with you.

What Is the Processing Time for the EB-5 Application?

The processing time for the EB-5 application differs, generally varying from 18 to 24 months. Factors influencing timing consist of application volume, thoroughness of documents, and any prospective ask for additional details from migration authorities.

Exist Restrictions on Where I Can Live in the united state?

Yes, there are typically no restrictions on where you can live in the U.S. after obtaining a visa, enabling for versatility in house option. Particular conditions may use based on visa kind and laws.

Can I Help Any Type Of Employer With an EB-5 Visa?

Yes, people holding an EB-5 visa are permitted to benefit any type of company in the USA. This versatility enables them to check out numerous work opportunities across varied markets without specific company restrictions.

What Occurs if My Investment Does Not Do well?

If your investment does not prosper, you may deal with economic loss, and your eligibility for long-term residency might be endangered. It is necessary to perform thorough due diligence and consider prospective dangers before investing.

Unlike regional facility financial investments, which pool funds for numerous projects, direct investments need people to spend directly in a new commercial venture. The success of these financial investments hinges on extensive due diligence, as the investor assumes even more threat and responsibility compared to passive investments in regional. Financiers can accomplish this job production demand via numerous financial investment choices, mainly by either straight financial investment in a new industrial enterprise or by spending in a Regional. The investment is generally structured as a funding to the project, permitting for the prospective return of the major amount after the investment period, which generally covers five years. Once a financial investment is made, the applicant has to finish Kind I-526, Immigrant Request by Alien Investor, which needs thorough details regarding the investment, the resource of the funds, and evidence demonstrating that the investment will maintain or produce at the very least ten full-time jobs for United state employees.